How to invest in share market in 2022? The importance of this question increases a lot when you want to make your dream in share market but can’t understand how to invest in share market?

Actually there are two sides to this question. One, either you are a beginner and you do not understand how to enter/start in the stock market.

Or second, you may have been investing in the stock market for a few years now but are skeptical about what you should and should not do to make a good start in investing.

So ! Whatever the reason, if you have decided to invest in the stock market, it can prove to be one of the best decisions for you financially.

Because you do not need to be a chartered accountant, mathematician or an expert in economics to make money in the stock market.

Yes! You will need some time to learn the basics of stock market, learn about companies and do fundamental analysis and technical analysis of their stocks.

Fair warning – the stock market is not a “get rich quick” type of deal, whether you are a beginner or an expert in the stock market.

Remember, investing in the share market is a never-ending learning process that requires patience and discipline.

For which the first and most important step is to learn to invest in the share market in the right way which can lead you to success.

And only then you can become a successful investor like Warren Buffett, Rakesh Jhunjhunwala, Ramesh Damani, Shankar Sharma etc. Who rose above the ranks of the common investor to become a billionaire investor.

This post is for investors like you who are just starting out and know little or nothing about the stock market. Here, you’ll find all the steps you need to take to turn your investment and trading aspirations into reality and answer your questions.

Continue reading ! In the next few minutes, you will have accurate information about “How to start investing and trading in the stock market”.

How To Invest In Share Market [2022]

First of all let us understand what are shares and stock market.

What is Equity Share?

In colloquial language, share means equity share. Share is also known as stock or equity. Equity shares are issued by companies. Which we buy and sell in the stock market.

A share of a company also represents the smallest unit of ownership in that company. Whenever you buy a share, a share certificate is issued as a proof.

Which are in electronic form and are deposited in the form of dematerialized document with any depository (bank, broker, financial institution) of NSDL (National Securities Depository Limited) or (CDSL Central Depository Services (India) Limited).

Now you cannot keep the shares in physical form. Suppose a company issues 1000 shares and you buy 10 shares. So it would mean that you become the owner of 1 percent in all the assets (land, factory, patent rights etc.) of the company.

Therefore, whenever you buy shares, assume that you are going to buy ownership in the company and as the company grows, the price of your shares will also increase.

This is the great mantra for investors to make money in the stock market.

What is Share Market?

The share market is made up of two words- share + market. Share means stake and market is the place where you can buy and sell any item.

Thus you can say that stock market is a place where shares of listed companies are bought and sold. It is no longer a physical place like it used to be.

Now the share market has become a digital place where you can invest and trade from any corner of the world.

Imagine that you want to buy ten shares of Reliance Industries Limited, then you do not need to go anywhere for this. You can buy the said shares through your computer or mobile phone sitting at home.

Equity market or stock market is also another name of share market.

As we discussed in the beginning, there are two aspects to this question. So now we will discuss the first aspect that what one needs to do to get started in the stock market.

How to enter/start in the stock market?

Step 1: Decide how to invest in the stock market

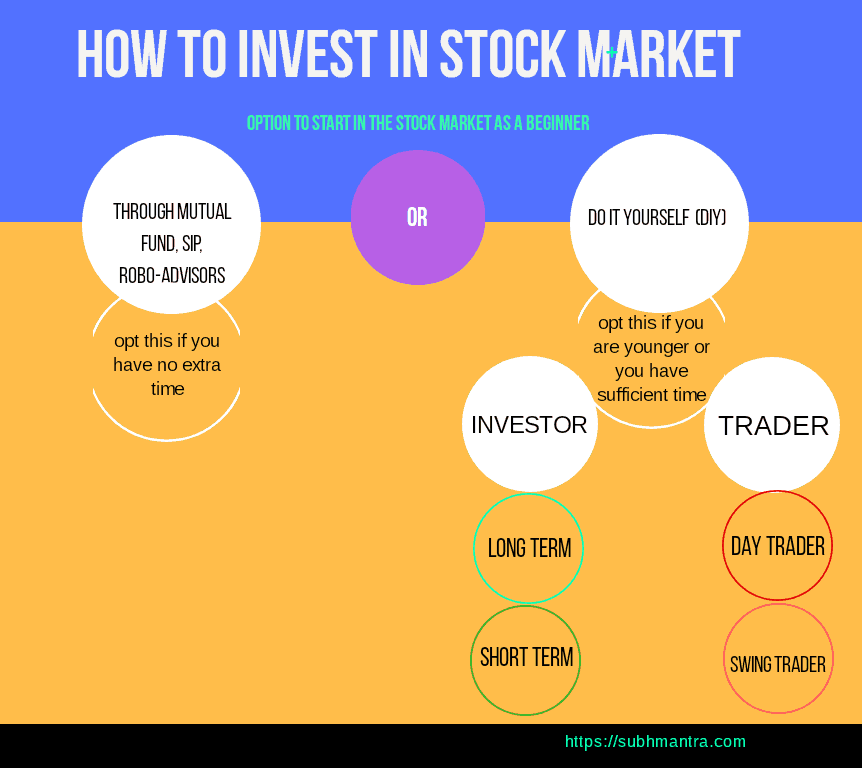

You should first decide whether you will do the work of investing in the stock market yourself (DIY) or someone else will do it on your behalf. Because maybe you are associated with job/business and you are short of time.

Since nowadays various types of financial instruments like bonds, mutual funds, SIP, derivatives (Futures & Options) are also traded in the stock market. So you have two options to start with-

The Active Option:

Where you actively do your own investing and/or trading in the stock market. DIY stands for “do it yourself”.

The Passive Option:

Here you get the benefit of investing in stocks but you do not need to make personal investment decisions.

Someone else (robo-advisor or human management consultant) manages all these operations and funds for you. Naturally some additional fees have to be paid.

You can decide for yourself how it will be right for you to start in the stock market. This post is suitable for those investors who want to choose only active option i.e. DIY type option which has lot of potential in future.

Step 2: Learn More About the Stock Market

You must have often heard others say that after investing money in the stock market, you will learn on your own. Certainly this is not a good advice. “Learn to Earn” is absolutely true in the context of the stock market.

Share market is always associated with high risk. That’s why you must learn a lot to maximize your profit and minimize losses before you begin. Know in detail the structure of the Stock Market which will help you to understand it better.

To increase your knowledge, you can watch YouTube videos related to the stock market. Websites or blogs like SubhMantra, TradeBrains or Investopedia can be read.

You can also watch TV channels like NDTV Profit, CNBC Awaaz. But only for information and not for investing in stocks suggested by them.

Try to read related newspapers, magazines like Business Today, Dalal Street Journal, Economic Times etc.

Step 3: Open a Brokerage Account

Investment and Trading are two different major aspects of the stock market for DIY. But you cannot start with the stock market without a Broker. You need a stockbroker to buy and sell any shares.

A stock broker is the important link that leads the investor to the stock market. There are many stock brokerage houses in the United States. Charles Schwab, Fidelity Investments, E*TRADE and TD Ameritrade are some top brokerage houses there.

Nowadays, two types of Stock Broking Companies are working in the stock market. They are Traditional or Full Service Brokers and Discount Brokers.

In India, Some top and full service brokers are Angel Broking Pvt Ltd, BSE Ltd, Religare Securities etc. Almost every bank in India also works as brokerage houses like Kotak Securities, HDFC Securities, ICICI Direct etc.

Top Discount Brokers are Zerodha, Upstox, 5paisa.com etc.

Selection of Good Broker

To open a brokerage account you have to select a good broker which will facilitate you in investing and trading. You should keep some points in your mind selecting a good broker:

- Brokerage and other charges they charged

- Customer services and support

- Research desk and leverages

- Call n Trade services

Discount brokers provide investing on trading platforms for the investor but do not provide advisory services or guidance. Note that their Brokerage charges are relatively very low.

While brokerage charges with full service are high but they tag along with services like products for first time investors, personal advisers etc.

In the market, it is suggested to go with full service brokers if you want to invest for a long time and if you want to trade in future then it is better to open an account with discount brokers.

Your Stockbroker opens two types of account –

Demat Account

A Demat account is must to start in the share market. It is similar to any other bank account, except that it is used to hold securities and other financial instruments in dematerialized form.

The procedure to open a demat account online is almost the same across different Stockbrokers. Also the list of mandatory documents required to open the account is the same.

Trading Account

Trading account is not necessary for investment. But it is better to open this account at the same time so that you can trade in future.

You can contact a stockbroker by visiting his website or simply you can make a phone call to open a demat account. An authorized person of that broker will visit your home and your account will be opened.

Documents Required for Opening Demat Account

There are different types of documents required to open a demat account:

- Proof of Identity (POI) (Eg.: Driving license, Govt ID card)

- Proof of Address (POA) (Eg.: Passport, Voter ID)

- Proof of Income (For trading in derivatives such as F&O) (Eg.: Copy of ITR Acknowledgement, Salary Slip, Bank Statement)

- Proof of Bank Account (Eg.: Cancelled cheque, also needed for linking your demat account to saving account)

- PAN Card

- 1 to 3 passport size photographs

Congratulations! Now you can transfer even a little money from bank account to demat account and can buy shares.

Investing in Share Market- Good Practice

Now, we will briefly discuss the second aspect of investing in the stock market which is very important for a successful investor.

It is important to know what not to do before doing what to do in the stock market.

How to invest in share market – Not to Do

1. Do not invest too much money in the stock market at once,

2. Do not invest in the market by taking loans,

3. Do not invest money in the market on the advice of anyone,

4. Do not buy shares without doing fundamental analysis as well as technical analysis.