Options Calculator is a very useful tool for options traders. It is used in many ways during options trading.

Whether options traders want to find the fair value of a call option or a put option, or calculate the value of an option greek, the options calculator is useful everywhere.

You can visit the SAMCO Option trading calculator to find the fair value of a call option or a put option.

But can there be any option calculator which makes options trading practically easy for the options trader without doing complex calculations? Which can give you minimum risk and maximum reward for each of your trades.

Yes! Today we are going to talk about one such option calculator, by learning its proper use, you can make a great start in options trading.

So let’s get started. In the first part of the post, we will learn the option calculator in theory.

In the second part we will try to understand options calculator with four recent (as on June 21, 2021) examples of call options and put options of Nifty and Bank Nifty.

Stock Calculator as Option Calculator to Earn Money

It is based on level-trading. In market experts view, all movements in the price of an underlying asset are level wise. They move in an organized manner.

Markets have memory which we interpret by various names like support and resistance, gap-up and gap-down theory and even trends. These are not random but established concepts.

Steps to Calculate Options Price Entry & Exit Targets

1. First decide which index or stock options contracts you want to buy or sell.

2. Now you open the technical chart of the respective option contract one day before (after market close). Find the high and low values of the last candlestick on the 15 minute candlestick chart. Note these values.

3. Go to the Stock Market Calculator page.

4. In the stock market calculator, input the values you noted in Step 2.

5. The stock calculator will show you the golden crossover, stop loss and implied volatility as well as several target price calculations.

6. You can note down all these values or even take a screenshot.

7. Now you are all set to make money while trading options.

How to Use the Option Trading Calculator Wisely

Some abbreviated technical terms are used in share market calculator, which you can visit here to understand their meaning. You will get all the terms twice. One of which is valid for uptrend and the other for downtrend.

1. Wait for sometime (15 to 30 minutes) after the market opens.

2. However, you will feel that trading at a lower price can lead to higher profits. Still don’t trade between TDP (Trend Deciding Price) at all.

3. Buy a call option or sell a put option if the underlying stock or index price moves above the TDP (for a positive trend).

4. Buy a put option or sell a call option if the underlying stock or index price moves below the TDP (for negative trend).

5. To protect your capital, GC1 and SL2 are the two stoploss levels in the form of a golden crossover. GC1 is your first stoploss and SL2 is the last stoploss for your trade.

6. GC2 has a different meaning. This is the stoploss when you sell at TDP (of the uptrend zone) and expect the price to go down or when you buy at the TDP (of the downtrend zone) and expect the price to go up.

7. There are 6 targets for profit booking. It is not necessary that the market achieves all the targets in intraday. You can either book profit on the upcoming target or wait for the next target by placing a stoploss just below the achieved target.

8. Remember target 2 is the strong reversal point in both the trends.

9. But if the price of a option opens above the target 2 and it remains above this level during the market hour, it means that the price has a strong tendency to move up. In this case option contract (call or put) can be bought provided the stoploss is placed just below the target 2 level.

10. In addition to the 6 calculated targets, there may be other sub-targets in between. But sub-targets are not shown in the calculator to avoid confusion and make it easier.

11. So you should follow the rules of options trading. Put your greed aside and exit with the nearest profitable targets. Because option prices tend to be more volatile. The next goal you are hoping for may be achieved but not at the time you expect it to be.

12. To make big money in options trading one must do technical analysis of spot price using the best technical indicators along with the above targets.

Through back-testing, you can draw several conclusions from the options calculator. Try it.

Options Trading Calculator Examples

Let us now learn the option calculator through examples.

1. Nifty Call Option – Suppose you decided to buy a call option on 21st June 2021 with strike price 15800 and expirtion date 24th June 2021. For this you open the technical chart of June 20, 2021 and note the high and low values of the last candlestick (3.15 hrs to 3.30 hrs). These were 66.95 and 55 respectively.

Now let’s calculate different targets and levels with the help of stock calculator. Which were as follows-

| UP TREND | |||||||||

| 2nd SL | GC1 | TDP | GC2 | T1 | T2 | T3 | T4 | Extreme 1 | Extreme 2 |

| 61 | 62 | 66.95 | 74 | 76 | 92 | 126 | 212 | – | – |

| DOWN TREND | |||||||||

| 2nd SL | GC1 | TDP | GC2 | T1 | T2 | T3 | T4 | Extreme 1 | Extreme 2 |

| 61 | 59 | 55 | 50 | 49 | 40 | 29 | 17 | – | – |

Now the question is that the next day the option price can open at any level. Since the volatility is very high in the first 15 minutes. So you wait 15 minutes.

The opening price, high, low and closing price of the call option in the first 15 minutes of market opening on 21st were 25, 33.45, 16.50 and 30.3 respectively.

Case1 – Now you could be ready to do trading. As 15800 call option opened near target3 of the down trend and was again trading near target3 after hitting target4.

Hence the call buyer had only two options. Either do not trade then or buy the call near the target3 of the down trend and place a stop loss below it. In such a situation, there were many levels available to you to exit the position.

Case2 – After 12.30 pm it was trading near its target 2 where there was a possibility of a strong upside. Where you could have bought it near 36 and put a stop loss of 28.50 just below target2. Where you could easily get out around 60. With this you would have made a profit of (60-36=24) i.e. 24*75=1800 rupees.

Case3 – Or if you had decided not to buy between 55 and 66.95 you would have no need to take the position. In this situation you would have neither profit nor loss and your capital would be safe.

2. Nifty Put Option – Similarly, you can also interpret the put option price.

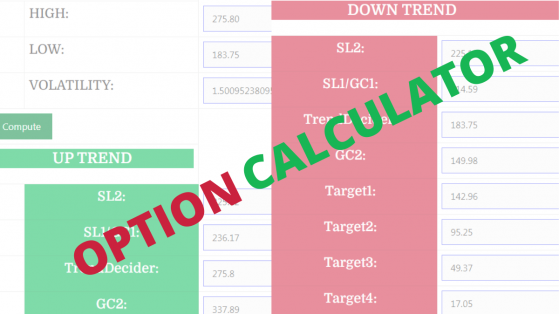

3. Bank Nifty Put Option – If you look at the graph, you will find that the put option could have been shorted around 275 with a stoploss of 338 after 12 noon. Whose down trend was more likely to go to the target level 2 and also went near 110. Which could give profit up to 4000.

| UP TREND | |||||||||

| 2nd SL | GC1 | TDP | GC2 | T1 | T2 | T3 | T4 | Extreme 1 | Extreme 2 |

| 225 | 236 | 275.80 | 338 | 354 | 532 | 1026 | – | – | – |

| DOWN TREND | |||||||||

| 2nd SL | GC1 | TDP | GC2 | T1 | T2 | T3 | T4 | Extreme 1 | Extreme 2 |

| 225 | 215 | 184 | 150 | 143 | 95 | 49 | 17 | – | – |

Option Calculator Profit

Option calculator profit is as follows-

- No need for complicated calculations

- Easier and more beneficial than calculating the fair value of options

- Less reliance on technical charts, especially for beginners in options trading

- Equally important for both option buyer and option writer

- Option calculator is a great tool for low risk and high rewards.

Since option trading is considered more risky than other assets. So do paper-trading and back-testing first. Once you have learned the right method, there is no better investment than options trading.

Your feedback matters. Please comment where improvement is needed.