Types of stocks– do you know ??

I just wrote a post – ‘Types of Shares‘. Do the two look alike?

You are right, but both posts are completely different. The post you are reading now is going to be very useful from the perspective of retail investors.

Benefits of knowing the types of stocks

- This gives you a better understanding of investing in the stock market in a defined way rather than your random investment ideas.

- This can help you efficiently reduce your investment risk in the long term through diversification.

- The number of shares listed on stock exchanges in any country is almost as high. And amidst all this it is challenging to find a better stock. It helps there.

- There is a popular saying in the stock market that you should not put all the eggs in one basket. It is recommended by market experts to include different types of stocks in your portfolio. When you get to know the types of stocks, you start making easy investment decisions.

In this post I have tried to include only those types of stocks which are important from an investment point of view.

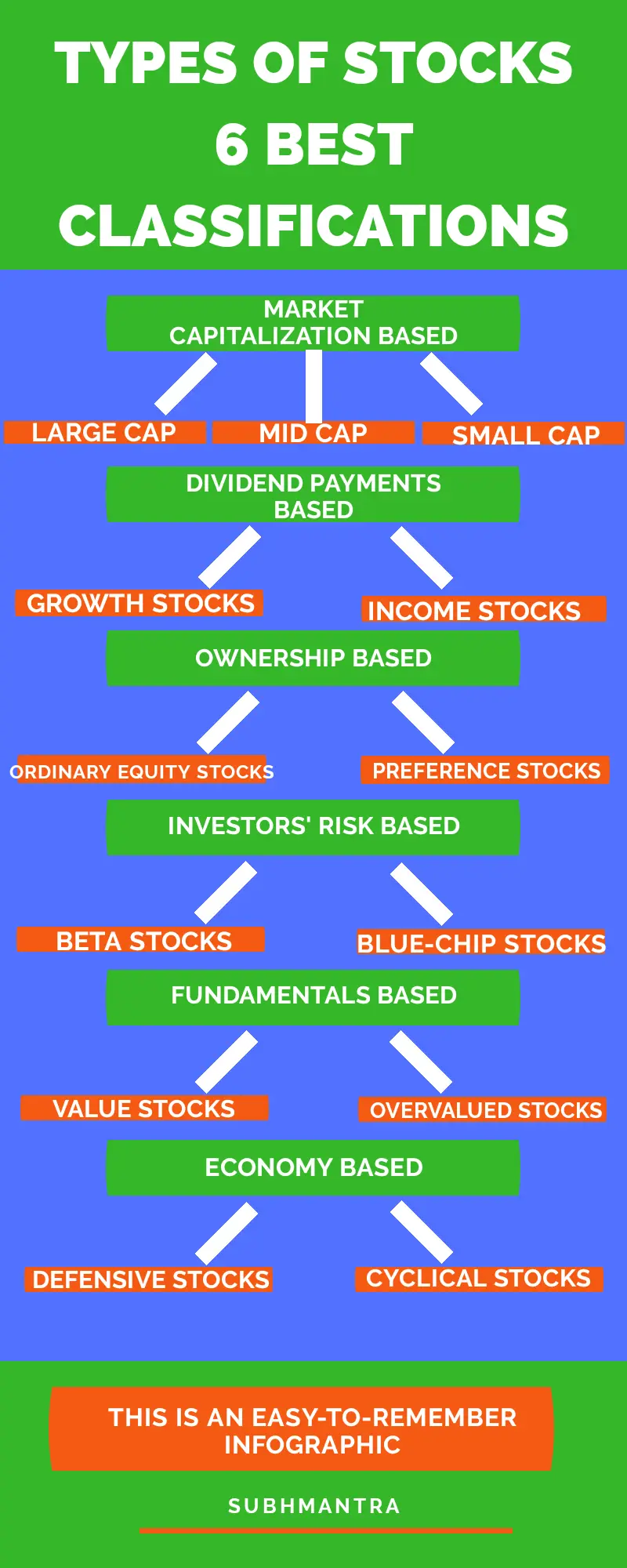

There are several ways to classify types of stocks. These are –

1. Types of Stocks based on Market Capitalization

Let me first define what is market capitalization?

Market capitalization refers to the total dollar market value of a company’s outstanding shares of stock. Commonly referred to as “market cap,” it is calculated by multiplying the total number of a company’s outstanding shares by the current market price of one share.

Source: Investopedia

Actually it is the net capital of a company calculated based on the daily performance of the company’s stock in the stock market. The market capitalization formula is –

Market capitalization of a company = Closing price of the Share (CMP) × Number of outstanding shares of the company

Market capitalization is not only useful in comparing the size of companies, but also in ranking the relative sizes of stock exchanges by measuring the sum of the market capitalization of all the companies listed on each stock exchange.

It is interesting to know that the New York Stock Exchange (NYSE) is the world’s largest exchange in terms of market capitalization.

A high share price of a stock does not mean a high market cap. The market cap itself indicates how strong and established the company is financially, not the share price.

There are three types of stocks based on market capitalization.

But the market cap limit in the definition is just for your guidelines, not necessarily accurate. Since there is not a hard and fast rule for such classification. It varies from time to time and from country to country.

This variance is due to some factors such as inflation, population changes and overall market valuation.

By visiting the stock exchange website, you can easily know what is the market capital of any stock and whether it is large cap or mid cap or small cap.

Large Cap Stocks

In the Indian stock market, a company with a market capitalization of over Rs 25,000 crore is called a large-cap company. And shares as large cap stocks.

But to be a large-cap stock in the USA, the market cap must be $ 10 billion or more.

Characteristics of Large-Cap Stocks

Pros

- Large-cap stocks are already well established and financially sound company. So investors can easily invest in it for a long time.

- Usually all blue-chip companies also have large caps.

- These are high dividend paying stocks.

- Larger cap companies have greater ability to survive in adverse economic conditions.

Cons

- Having large cap companies does not mean that they are highly growing companies.

Procter & Gamble, Microsoft, Apple, RIL, Asian Paints, etc. are examples of large cap stocks listed on various stock exchanges.

Pro Tip: You can invest in large cap stocks only on the basis of fundamental analysis.

Mid Cap Stocks

Companies with a market capitalization of between Rs 5,000 crore to Rs 25,000 crore (between $ 2 billion and $ 10 billion in the US) are mid-cap companies.

However, investing in mid-cap stocks is more risky than investing in large-cap stocks. Nevertheless, mid-cap companies have a good growth record. And a great opportunity for the investor as well!

Bata India, MRF, Tata Power, Arista Networks, Anaplan, and Redfin, etc. are examples of mid-cap stocks.

Pro Tip: Before investing in mid cap stocks, you should do both fundamental and technical analysis so that you can invest in a good company at a reasonable price and time.

Small Cap Stocks

Small cap companies are companies with a market capitalization of less than Rs 5,000 crore (between $ 300 million to $ 2 billion in the USA).

These stocks may have high potential to grow fast. But it has also been observed that investors sometimes suffer heavy losses due to high volatility in such companies.

Small caps are almost either start-up companies or have unexpectedly low-priced shares (Penny Stocks) due to financial failure.

Pro Tip: It is better that you do not invest in such companies initially. Even if you invest, it should not be more than 5 to 10 percent of your total investment.

Study the company closely before investing. Check the balance sheet on quarterly basis and pay special attention to technical analysis.

If you are able to find a good small cap company, you can expect very good returns.

Ujjivan Small Finance Bank Limited, TV18 Broadcast Limited, SpiceJet Limited, RVNL, ABX Air Inc, Astro Biosciences Inc, etc. are examples of small cap stocks.

Remember, all small caps are not a penny stock.

Market Caps Summary

| Classification | Market Capitalization (in the United States) | Market Capitalization (in India) |

|---|---|---|

| Large Cap | $ 10 billion or more | More than Rs 25,000 crore |

| Mid Cap | Between $ 2 billion and $ 10 billion | Between Rs 5,000 crore to Rs 25,000 crore |

| Small Cap | Between $ 300 million to $ 2 billion | Less than Rs 5,000 crore |

2. Types of Stocks based on Payment of Dividend

Dividend is a very popular term among investors as a source of passive income. To get detailed information you can read the post- High Dividend Paying Stocks.

There are basically two types of stocks based on the payment of dividends to shareholders –

Growth Stocks

Globally known Google (Alphabet Inc.), Warren Buffett’s Berkshire Hathaway, etc. are the best examples of growth stocks.

As a growth stock, a company again invests its profits in company expansion and other projects. Therefore shareholders do not receive high dividends.

Growth stock companies are committed to growing their business and hence the stock price. This is more beneficial for investors as the share price rises faster.

But in some situations it becomes risky for investors. For example, in the bear market, almost all stocks fall in price. In that case, growth stocks also do not perform well.

Then if these stocks are not able to perform as expected then the share price decreases. And shareholders may suffer losses.

Income Stocks

High dividends in income stocks are a regular source of income for shareholders. Generally the company of income stocks provides a continuous dividend to the shareholders.

In such a situation high growth cannot be expected by the company and hence the stock price does not increase significantly. You can invest in these stocks for a long period with little risk.

These shares show low volatility in the share price and provide a high dividend payout ratio. These are typically companies related to natural resources, real estate or energy sectors.

3. Types of Stocks based on Ownership

However, investment in any share of a company gives the right of ownership. But people who have started a company are getting more priorities.

This is exactly the kind of part I have discussed in previous post- Types of Shares. In shorts, there are two types of stock prominently by ownership –

Ordinary Equity Stocks

These are shares of various companies readily available to common investors in the secondary market. Ordinary equity shareholders are not guaranteed to receive dividends. But they have voting rights.

Preference Stocks

These stocks are not available to all investors. But preference shareholders are guaranteed to receive dividends every year. In many cases their rights are given priority.

When the company grows, the price of equity shares in the stock market increases, which benefits the ordinary equity shareholders the most, but this is not the case with preference shares.

4. Types of Stocks for Investors based on Risk

Although there is some risk associated with any business or investment. But there are some stocks in the stock market that naturally increase or decrease your risk further. By the way, there are two names –

Beta Stocks

Beta stocks are referred to highly volatile securities, having a high degree of responsiveness to all market fluctuations. All share market instruments have a corresponding stock beta, evaluated against the potential risk and return parameters as per market performance and underlying strength of an issuing company.

Source: Groww

Stock market analysts use the parameter Beta to know the risk quotient. The higher the beta, the greater the volatility and risk.

It is also true that the higher the risk, the higher the return. Some smart investors in the stock market also take advantage of this by investing in beta stocks. But beginners should stay away from such stocks.

Blue-Chip Stocks

Blue-chip company has no fixed definition. It is used for all companies which are generally considered as good investments.

They are mostly companies with a high reputation for honesty in business, well-established with profit growth, high technology level, strong administration and quality management and a long record of timely dividend payouts.

Blue chip companies have low liabilities and steady income. It is always a personal choice. It is not necessary that every investor gives blue chip status to a particular stock.

You can easily pick up blue-chip stocks among the major index components. For example, after fundamental analysis, the NIFTY 50 and SENSEX shares can be considered as blue chip stocks.

There is always a high and constant demand for these shares in the stock market. Due to which their prices are high and relatively less volatile.

5. Types of Stocks based on Fundamentals of the Company

It is but natural that if the fundamentals of a company are good, it will grow in future and thus its share price will also increase.

This is the basic concept of value investing. Value investors like Sir Warren Buffett and Mr Rakesh Jhunjhunwala always search for finding the intrinsic value of a stock.

Intrinsic Value

The intrinsic value of a stock is the true value of the stock of a company in the present scenario.

Sir Benjamin Graham’s had oriented the concept of value investing in his world’s most popular stock market related book “The Intelligent Investors”. Fundamental analysis of a company is the best way to find stock’s intrinsic price.

On the fundamental basis, there are two types of stocks. One is overvalued and another is undervalued stocks.

Overvalued Stocks

Overvalued stocks are stocks whose current market price (CMP) is higher than its intrinsic value.

It is not advisable to buy overvalued shares at the same time. Wait for the stock price to correct.

Undervalued Stocks or Value Stocks

Value stocks are somewhat difficult to search. You have to check this in routine way. The current market price of a stock is anyhow below its intrinsic value is known as undervalued stocks or value stocks.

This difference between intrinsic value and CMP assures the investor to be significant growth in coming future.

6. Types of Stocks based on Economy

As you know, the stock market and the economy reflect each other. If the country’s economy is good, then the stock market is also booming. And when the economic situation is not good, the stock market also does not perform well.

But there are some stocks in the stock market that protect your investment even in bad financial condition. And some stocks are only able to perform well under the good state of the economy. In this way, you will find two types of stocks based on economy –

Defensive Stocks

Defensive stocks are those whose prices remain stable at a time of market downturn. These are non-cyclical stocks.

The business nature of these companies is different. These are often related to the products or services associated with our common needs. Therefore, their demand remains in the recession.

Companies in the food and beverages (utilities), drugs (pharma) and insurance sectors are good examples of defensive stocks.

Cyclical Stocks

Cyclical stocks are those that move up or down in sync with the business cycle. These companies cater to the needs of growing economies. This is why they only perform better in a growing economy.

Housing industries and industrial equipment companies (automobile industries) are the best examples of cyclical stocks.

Conclusion

Hopefully you will have understood better that types of stocks are important for your investment.